BHIM app has made digital payments more straightforward by facilitating fast and safe transactions via UPI. Designed by The National Payments Corporation of India (NPCI), BHIM directly interfaces with your bank account to streamline the process of transferring and obtaining money. Let's find out more about the app and discover the ways to install it on your mobile phone.

The Bharat Interface for Money (BHIM) application is:

In its essence, the BHIM app simplifies the process of digital transactions. It accomplishes this through:

Importantly, this platform distinguishes it from other electronic wallets as it does not hold money within the app itself, but rather facilitates direct bank-to-bank UPI transactions. The backing by the government confers additional trustworthiness to BHIM. With its introduction being part of a broader initiative towards reducing reliance on cash in financial dealings, such aims are expected to catalyze expansion in digital payment usage throughout India. Demonstrating considerable progress since launch, as of October 2021 data shows that transaction values processed via BHIM hit $100 billion – underscoring substantial influence over time.

The BHIM app is distinguished by several essential attributes that differentiate it from other digital payment platforms. Most prominently, the ability of the app to transfer money instantly between 170 banks associated with UPI stands out. This ensures users can conduct transactions on BHIM swiftly at any time, eliminating concerns over traditional banking operation hours and transfer delays.

What also makes the BHIM app attractive is its ability to manage a wide range of transaction types. The application allows users to execute payments using various methods including UPI IDs, QR codes, and mobile number registered on UPI — embracing a broad spectrum of preferences among its clientele. Such adaptability guarantees straightforward and effective proceedings whether one is settling bills with local vendors or sending funds to acquaintances. Important, that users can easily save details of the beneficiary to ease future transactions.

The BHIM app is crafted to cater to a wide-ranging user base, which significantly enhances its usability for digital payments throughout India. It’s distinctively designed for universal compatibility with all types of mobile phones, thereby enabling access irrespective of the phone’s make or operating system.

To hardware adaptability, the BHIM app transcends linguistic barriers by offering support for multiple Indian languages. As it stands, users can operate the app in 20 different languages. The broad language assistance provided by BHIP ensures that individuals from numerous linguistic backgrounds can use the application seamlessly.

BHIM caters adeptly not only to individual customers seeking effortless person-to-person transfers, but also merchants who desire efficient methods to receive money from their clientele via digital means. To engage with what BHIM has to offer, just download the latest version of the app from freesoft.net. Let's find out how to install this program for free.

Acquiring and setting up the BHIM application is designed to be an efficient process. If you’re utilizing Android devices, make sure your gadget runs on a verified version of stock Android to ensure compatibility. Those who cannot, or have no will to use Google Play Store, can download the app nfrom freesoft.net. Head to the top of this page and locate the 'Download' button. Tap on it and when the process is finished - launch BHIM APK file and follow the prompts. Those using iPhone devices can obtain the program from the Apple App Store.

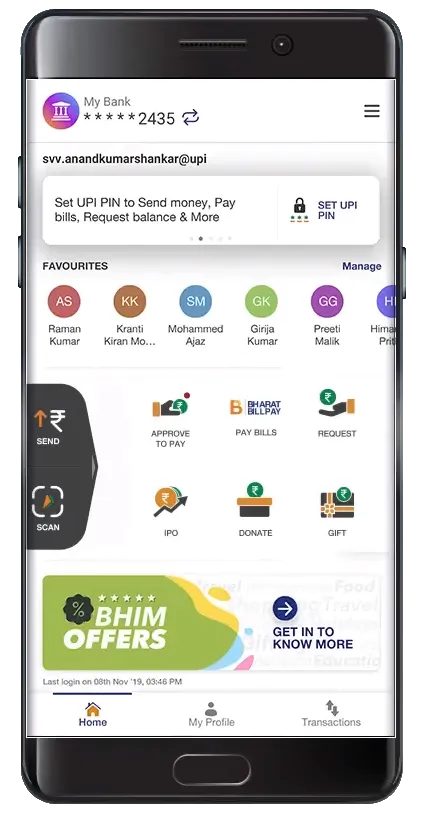

Upon completing the download, BHIM presents an intuitive interface that will guide new users through its initial configuration steps. You’ll need to authenticate your phone number as part of this process before you can link your bank account details. After that:

Next, Set UPI PIN for your linked account, by providing both 6-digits found on your debit card alongwith its expiry date information. This is necessary for every UPI App to send money or receive funds. After everything has been arranged correctly, you are set to use the BHIM to pay online or receive money from clients or other users.

The BHIM app is renowned for its accessible interface. It is suitable even for users, that may not be tech-savvy. The straightforward and easy-to-use layout enables quick navigation from the home screen to crucial functions such as sending money, receiving payments, checking bank account balances, and examining past transactions. This simplicity ensures that even newcomers to digital payments can utilize the services provided by the app with little difficulty.

The primary function of the BHIM app is to enable quick and secure money transfers. It facilitates users in sending and receiving funds, enabling direct payments from bank accounts without intermediaries. These features are highly beneficial for real-time fund transfers that can be executed anytime, including on weekends or during bank holidays.

Various methods available to conduct transactions include:

These multiple modes provide flexible ways to accept payments across various transaction types, allowing seamless transactions whether you’re settling bills with local vendors, splitting expenses with friends, or compensating service providers. Since the BHIM app is compatible with all prominent Indian banks participating in the UPI system, its accessibility and convenience are greatly enhanced.

Safeguarding user information is critical for all digital payment platforms, and BHIM rigorously upholds this principle. Before any personal or financial data is sent over the internet, the app encrypts it to prevent unauthorized access. Only with a specific decryption key can the information be interpreted. This protection is provided through Secure Socket Layer (SSL) encryption, which creates a fortified channel of communication between the mobile device of the user and BHIM’s servers—thus ensuring that transactions are not just secure but also keeping private details confidential.

To validate identities accurately, BHim employs multi-factor authentication (MFA). Users must furnish multiple verification elements—for instance, their registered mobile number along with an M-PIN—to authenticate transactions securely. Those with compatible devices have options such as biometric validation including fingerprint scans or facial recognition providing additional security layers.

Grasping the details of transaction fees and limits for BHIM app usage is vital to navigating digital payments proficiently. There’s a daily cap on transactions through BHIM UPI at 1 lakh, applicable equally to transfers between individuals (P2P) as well as those from person-to-merchant (P2M). For users who are new to the platform, an introductory limit of Rs. 5000 is placed during their initial 24-hour period. This provides them with the opportunity to familiarize themselves with the service while starting their transactions.

A significant benefit of using BHIM is that transferring money between bank accounts doesn’t incur any charges for either consumers or merchants, ensuring cost-effective operations for regular financial activities. Transactions made by customers directly to merchants up to Rs. 2,000 come without fees. If this threshold is exceeded in P2M interactions, a fee amounting to 1.1% becomes payable by the merchant instead. Likewise, when one merchant engages in monetary exchanges with another (M2M), they must cover an interchange fee set at 0.5%. It’s pertinent also not overlook that although direct charges for conducting UPI-based payments through BHIM may not exist per se, your banking institution regarding possibly applied extra tariffs.

The BHIM application is a potent instrument for advancing digital payments across India, introduced by the NPCI with government backing. Its purpose is to encourage transactions without cash and to nurture a society that is proficient in digital capabilities. The app supports UPI and provides instantaneous money transfers along with an interface that’s easy-to-use and available in several languages, serving an expansive demographic while streamlining their monetary dealings.

In terms of security, the application safeguards user information through encryption coupled with multifactor authentication processes. It offers transparency regarding transaction fees which are kept low as well as stipulates explicit transaction limits. Whether catering to individuals overseeing their own financial engagements or merchants handling digital receipts of payment, BHIM supplies a steadfast and effective system tailored for diverse fiscal interactions. Download the latest version of BHIM app for Android from freesoft.net, and experience the benefits of the platform for yourself.

To rate BHIM you need to register or log in on our website

Mail domain must match the domain of the developer's site

A link to confirm registration was sent to your email